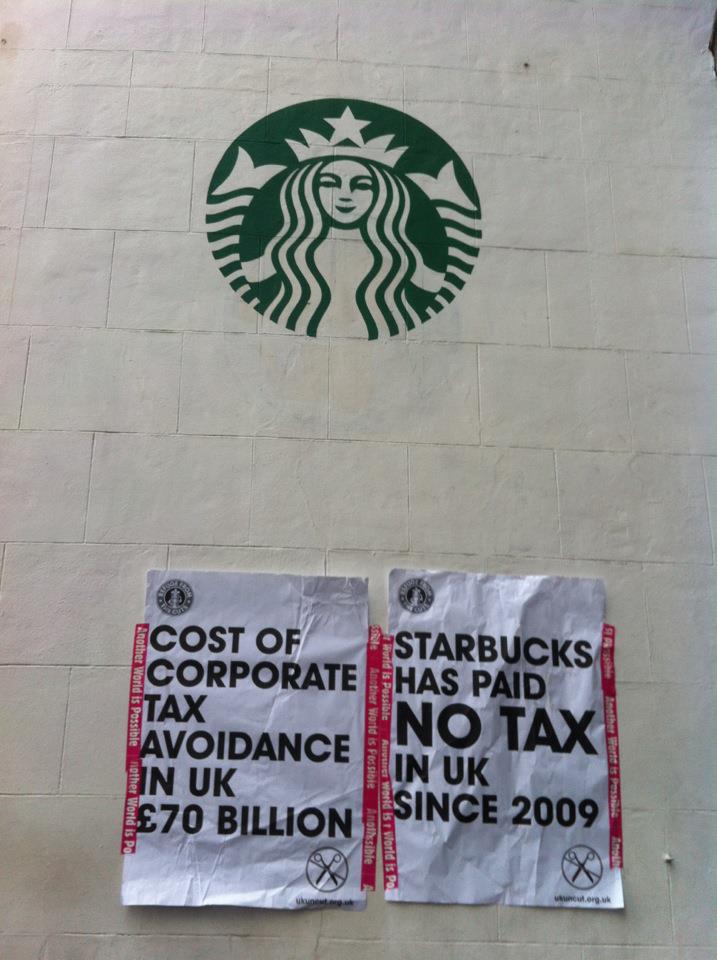

UK Uncut Starbucks Action

Starbucks across the country were turned into refugess and creches, Occupy Design helped out with some message posters for the media images.

Starbucks is one of the largest coffee chains in the UK, and the second largest café or restaurant chain in the world after McDonald’s. Yet, in the last three years they’ve paid no corporation tax at all, despite making sales of £1.2bn. Over the last 14 years they’ve only paid £8.6m in corporation tax.

Starbucks managed to pay no taxes by shifting money around between Starbucks companies in different countries, so that its accounts show it made a loss in the UK. Because of the way they’ve done this inside their global corporate empire no one knows exactly how much tax Starbucks should have paid. Comparing Starbucks to other similar US based multinationals, McDonald’s had a tax bill of over £80m on £3.6bn of UK sales. Kentucky Fried Chicken, incurred taxes of £36m on £1.1bn pounds in UK sales.

Here are three ways Starbucks managed to move their money out of the UK so they could dodge tax:

The Starbucks brand

Brands are worth money, and at the moment businesses can pay money to the part of their business that ‘owns’ the brand for the privilege of using it. In the UK Starbucks paid 6% of its total sales as a ‘royalty’ to Starbucks in Amsterdam – taking plenty of profit out of the UK to the Netherlands where they have a secret low rate tax deal with the Dutch government.

Swiss beans

Switzerland is not exactly well known as a coffee growing country, given that most coffee producing countries are in the tropics. Yet the country, better known for its role as a world tax haven, is where Starbucks buys all its coffee beans from. It appears Starbucks is buying very very expensive coffee beans from its own subsidiary in Switzerland, where commodities like coffee are taxed at 5%, compare to paying 24% corporation tax in the UK.

Bank of Starbucks

In the UK companies can deduct the interest they pay on loans from their taxable income, so they lend the UK company money from another subsidiary in a tax haven where interest payments aren’t taxed. Starbucks entire UK operation is funded by debt, and very expensive debt at that – a very very bad deal for the UK company, but a very good deal for the Starbucks company lending the money.